Retirement

Retirement

I know we've established that there is an old crowd here, but I was wondering how many are retired from full-time work.

- Ron Thorne

- Fadda Timekeeper

- Posts: 3072

- Joined: June 27th, 2013, 4:14 pm

- Location: Anchorage, Alaska

Re: Retirement

I haven't worked for someone other than myself for almost 2 decades, but have only been fully retired from "regular", daily work for about 4 years. After the age of about 50, I exclusively taught drums & percussion privately, which gave me great control and freedom over my hours and schedule.

Now, I volunteer twice weekly at one of our medical centers, but that's hardly full-time or "work".

Now, I volunteer twice weekly at one of our medical centers, but that's hardly full-time or "work".

"Timing is everything" - Peppercorn

http://500px.com/rpthorne

http://500px.com/rpthorne

- bluenoter

- Concierge

- Posts: 1514

- Joined: July 1st, 2013, 1:37 am

- Location: DC (Taxation Without Representation)

Re: Retirement

I'm retired from full-time work (unless one counts being the concierge at jazztalk.net—which I don't, because I set my own hours and every paycheck has been permanently lost in the mail).

Re: Retirement

I left my full-time job at the end of September, and I am now working part-time.

Even though I have a pension (small) and I am drawing social security, and get paid from my job, my income has dropped in half.

My wife is still working, and will be for 18 more months, so our household income hasn't taken a huge hit -- yet.

So, I am trying to adjust expenses downward.

Such as:

I've been working out with a "personal trainer" once or twice a week now for nearly five years. I've got to cut that out. I'll take classes at the local YMCA.

I was smoking expensive cigars for a while. Since it is costly and not a plus for my health, I've cut that out entirely.

Single malt Scotch will probably be the next to be cut out, at least daily consumption of it.

(Most) magazine subscriptions. (will read them at the public library now)

One of my New Year's resolutions was to not buy a book this year. So far, so good. (been making good use of the library on that front, too)

We still have quite a few discretionary expenses -- the tennis club, for example. We eat out fairly often, but avoid the fancy joints.

I haven't really missed anything (so far), but I want to try to be as frugal as possible without feeling deprived.

Even though I have a pension (small) and I am drawing social security, and get paid from my job, my income has dropped in half.

My wife is still working, and will be for 18 more months, so our household income hasn't taken a huge hit -- yet.

So, I am trying to adjust expenses downward.

Such as:

I've been working out with a "personal trainer" once or twice a week now for nearly five years. I've got to cut that out. I'll take classes at the local YMCA.

I was smoking expensive cigars for a while. Since it is costly and not a plus for my health, I've cut that out entirely.

Single malt Scotch will probably be the next to be cut out, at least daily consumption of it.

(Most) magazine subscriptions. (will read them at the public library now)

One of my New Year's resolutions was to not buy a book this year. So far, so good. (been making good use of the library on that front, too)

We still have quite a few discretionary expenses -- the tennis club, for example. We eat out fairly often, but avoid the fancy joints.

I haven't really missed anything (so far), but I want to try to be as frugal as possible without feeling deprived.

Re: Retirement

Left my job of 15 years last year, too. Tired of the job, tired of the company and was ready for a change. I tell people that I'm in "transition" now, but in reality am 'semi-retired'. Will be looking for some part-time work and probably some volunteer stuff in 2015.

It's a good feeling to break the 8hr/day, 5 day/wk monotony. I feel that now that I'm over 60 it's time to see if I can spend the rest of my years doing something I enjoy for a change, if possible.

It's a good feeling to break the 8hr/day, 5 day/wk monotony. I feel that now that I'm over 60 it's time to see if I can spend the rest of my years doing something I enjoy for a change, if possible.

Re: Retirement

That's my feeling exactly. Have you felt the pinch at all? Or does your freedom make you not mind it?

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

My take:

I've been retired since September of 2013. Fortunately, I have not felt the "pinch" financially. This is probably due to good planning, for once in my life. Several years before retiring I dumped as much cash as I could in my 401K. The fact that I never spent more money than I earned and never incurred large debt helped a lot. I have a pension as well as Social Security to which I've contributed for nearly 50 years. I also have a very decent amount of liquid savings (a conscious plan) that I can draw upon if need be. So far there is no need to draw from my 401k and I expect it will continue that way for the forseeable future. That is, until the guvmint compels me to withdraw 4% per year starting at age 701/2.

I buy what I want and live a very comfortable lifestyle. Joanne will be joining me in retirement in May of this year. I like to think my situation is a result of hard work and planning. But I would be kidding myself if I didn't admit that luck has played a part in my good fortune as well. That's my story and I'm sticking to it.

I've been retired since September of 2013. Fortunately, I have not felt the "pinch" financially. This is probably due to good planning, for once in my life. Several years before retiring I dumped as much cash as I could in my 401K. The fact that I never spent more money than I earned and never incurred large debt helped a lot. I have a pension as well as Social Security to which I've contributed for nearly 50 years. I also have a very decent amount of liquid savings (a conscious plan) that I can draw upon if need be. So far there is no need to draw from my 401k and I expect it will continue that way for the forseeable future. That is, until the guvmint compels me to withdraw 4% per year starting at age 701/2.

I buy what I want and live a very comfortable lifestyle. Joanne will be joining me in retirement in May of this year. I like to think my situation is a result of hard work and planning. But I would be kidding myself if I didn't admit that luck has played a part in my good fortune as well. That's my story and I'm sticking to it.

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

You're a professional at this retirement business, Clint.

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

Re: Retirement

As far as a "pinch", my story is similar to Jimmy's. Between luck and planning, things are working out pretty well so far.

I definitely see some part-time employment in the future, though - couldn't hurt.

I definitely see some part-time employment in the future, though - couldn't hurt.

- moldyfigg

- Founding Member

- Posts: 435

- Joined: July 1st, 2013, 9:07 am

- Location: Behind the Orange curtain

Re: Retirement

Seriously (rare for me), if you don't need the money then there are many opportunities to volunteer. You can find one that fits your timetable and desires without much effort.

Bright moments

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

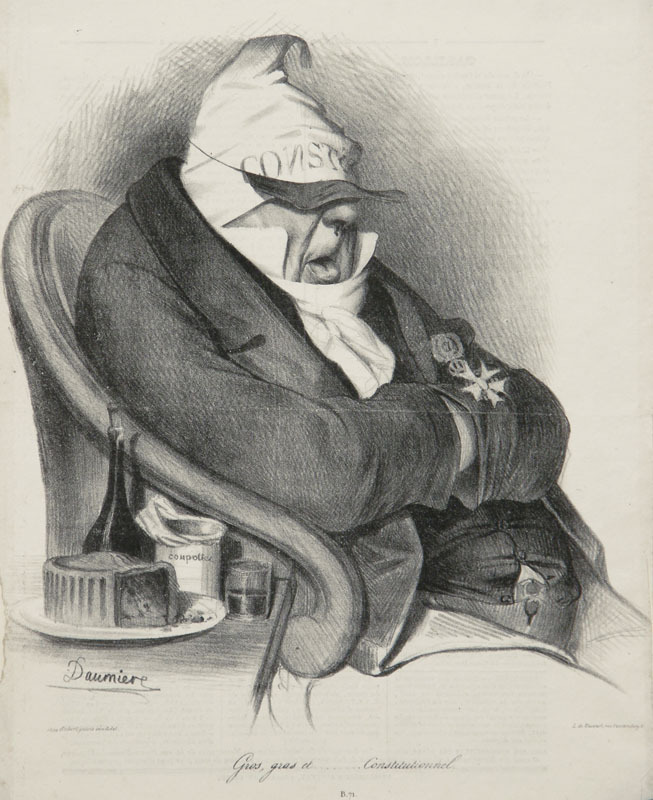

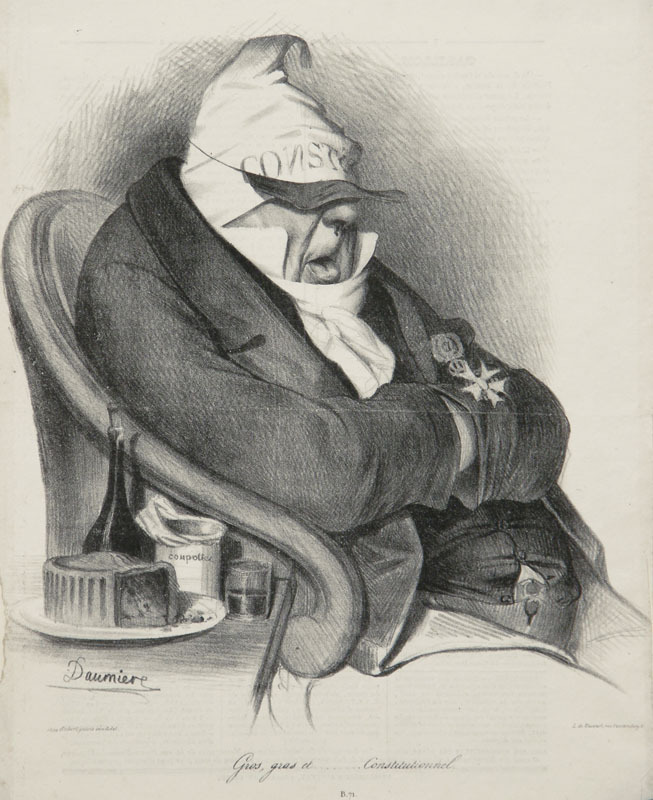

Brooks has to work part-time and Clint has to volunteer because they are not as adept at the fine art of loafing as am I.

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

- Ron Thorne

- Fadda Timekeeper

- Posts: 3072

- Joined: June 27th, 2013, 4:14 pm

- Location: Anchorage, Alaska

Re: Retirement

Jimmy Cantiello wrote:Brooks has to work part-time and Clint has to volunteer because they are not as adept at the fine art of loafing as am I.

Classic!

"Timing is everything" - Peppercorn

http://500px.com/rpthorne

http://500px.com/rpthorne

Re: Retirement

Jimmy Cantiello wrote:Brooks has to work part-time and Clint has to volunteer because they are not as adept at the fine art of loafing as am I.

I can get my "loaf" on when 'necessary,' but I tend to get nervous if I don't have something to do!

Re: Retirement

I lucked into a 10-hour-a-week job that pays me right under the earnings limits for taking social security at 62.

Most every financial planner I talked to told me to hold off on SS until I turned 66. I opted to take it at 62, thinking I could put the four years of SS income in the bank if I am miserly enough.

I've rolled over my 401(k) into a "managed payout fund" at Vanguard, but for now I am reinvesting the gains until I need the income. No need so far, but when my wife retires in 18 months, I might have to tap into it.

So, with the part-time job, SSI, a pension and the "managed payout fund," I have four potential streams of income.

We live on 56 acres in upstate New York on my wife's farm, which has been in her family for more than 150 years. My daughter, son-in-law and grandson plan on moving in about the time my wife retires from her public school teaching job.

The son-in-law, a professional carpenter, is planning on building an "in-law" apartment for us, and we four adults will all help with the expenses and/or maintenance of the house and out buildings (barns, sheds, etc.)

I definitely won't be living in a refrigerator box (which I thought for a long time was my destiny), but I won't be living high on the hog either. But, with a little luck, I might be able to afford a bottle of single malt every once in a while.

Most every financial planner I talked to told me to hold off on SS until I turned 66. I opted to take it at 62, thinking I could put the four years of SS income in the bank if I am miserly enough.

I've rolled over my 401(k) into a "managed payout fund" at Vanguard, but for now I am reinvesting the gains until I need the income. No need so far, but when my wife retires in 18 months, I might have to tap into it.

So, with the part-time job, SSI, a pension and the "managed payout fund," I have four potential streams of income.

We live on 56 acres in upstate New York on my wife's farm, which has been in her family for more than 150 years. My daughter, son-in-law and grandson plan on moving in about the time my wife retires from her public school teaching job.

The son-in-law, a professional carpenter, is planning on building an "in-law" apartment for us, and we four adults will all help with the expenses and/or maintenance of the house and out buildings (barns, sheds, etc.)

I definitely won't be living in a refrigerator box (which I thought for a long time was my destiny), but I won't be living high on the hog either. But, with a little luck, I might be able to afford a bottle of single malt every once in a while.

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

Looks like you're pretty much set, Jeff. Good on you!

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

BFrank wrote:Jimmy Cantiello wrote:Brooks has to work part-time and Clint has to volunteer because they are not as adept at the fine art of loafing as am I.

I can get my "loaf" on when 'necessary,' but I tend to get nervous if I don't have something to do!

I find that most people get uncomfortable if they are not doing something productive. Joanne is definitely not a "sitter arounder". She always has projects and goals. Me? I've developed a high tolerance for slothfulness so I'm good with just hanging out and watching the world roll by.

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

Re: Retirement

Before I "retired," I talked to quite a few retirees, some of whom were driven crazy because they no longer had something that organized their time for them. One guy -- who has an extremely nice pension and no need for income -- went back to work full-time with a job full of headaches because he was so bored.

Re: Retirement

Getting out of the house is important, even if I'm not doing something productive. Spending too much time in the apartment gets me crazy because I end up thinking about all the things I "should" be doing.

Re: Retirement

welcome to the club, rollie!

- stonemonkts

- Founding Member

- Posts: 180

- Joined: June 29th, 2013, 4:59 am

Re: Retirement

I can relate to everything posted in this thread. I worked in large corporations since college but from day one I knew it wasn't for me. I developed a savings/investment plan to get me out and it all came to fruition in 1999. Having no children made it possible, but I never wanted them anyway.

I consider myself semi-retired and self-employed. I keep very busy with managing portfolios for myself, and others, gratis, and studying and continuing to learn. I've never for a minute regretted getting out of the fray at such an early age (I was 40).

I'm still "only" 56 so I have 5+ years left until I claim early SS benefits. I've done the math six ways to Sunday, and unless you savor the notion of living into your 90s (I do NOT), waiting until full retirement age to claim just doesn't add up. It takes 12 years just to break even and finally start to be ahead of the game.

My greatest challenge is what Brooks said...keeping busy, and not spending time thinking about what I should be doing. It really is easy to drive oneself nuts.

Have acre-envy after reading Jeff's post. Thought I was sitting pretty on 10 acres...56? wow! Love that.

I consider myself semi-retired and self-employed. I keep very busy with managing portfolios for myself, and others, gratis, and studying and continuing to learn. I've never for a minute regretted getting out of the fray at such an early age (I was 40).

I'm still "only" 56 so I have 5+ years left until I claim early SS benefits. I've done the math six ways to Sunday, and unless you savor the notion of living into your 90s (I do NOT), waiting until full retirement age to claim just doesn't add up. It takes 12 years just to break even and finally start to be ahead of the game.

My greatest challenge is what Brooks said...keeping busy, and not spending time thinking about what I should be doing. It really is easy to drive oneself nuts.

Have acre-envy after reading Jeff's post. Thought I was sitting pretty on 10 acres...56? wow! Love that.

- stonemonkts

- Founding Member

- Posts: 180

- Joined: June 29th, 2013, 4:59 am

Re: Retirement

Not to derail this thread, but one of the instances it does make sense to wait to claim SS benefits is when your cash flow exceeds your needs before SS is factored in..because what delaying SS means is similar to holding an 8% lifetime annuity...holding off SS equals 8% annual guaranteed returns up to the day you actually claim, between full retirement age, and 70 years old. Not claiming at 70 only works if you absolutely adore your job and don't wish to stop working. There are a few other strategies that work well for some couples (claim and suspend, and take your spouse's benefits until he/she retires...and so on).

Anyway, for me claiming early makes sense. Didn't want to leave the impression that waiting to collect is a bad strategy...for many it fits the bill.

Anyway, for me claiming early makes sense. Didn't want to leave the impression that waiting to collect is a bad strategy...for many it fits the bill.

- Jimmy Cantiello

- Founding Member

- Posts: 360

- Joined: July 4th, 2013, 7:02 am

- Location: Monroe, Connecticut and/or Newfane, Vermont

Re: Retirement

Wow, talk about planning ahead. Good for you, Pat!

“I feel sorry for people who don't drink. When they wake up in the morning, that's as good as they're going to feel all day.” ― Frank Sinatra

Re: Retirement

Thanks, Pat -- grateful to hear your thinking on this. FWIW, I had breakfast with a PhD economist yesterday, who shares your opinion on taking at 62.

Re: Retirement

Uli, thanks... Now that I am "retired" and working part-time out of my house, I can look more often at the posts here. The place where I worked until last fall blocked many internet sites, including Facebook and this joint.

Who is online

Users browsing this forum: No registered users and 1 guest